Weekend Update #022

Welcome to Blue Room's Weekend Update. Each week, we're sharing what companies we're researching and the what, the who and the how that we think makes the companies interesting and unique. This roundup is brought to you weekly by a group of interns, creative minds, artists and investors who believe that through best in class investing along with the democratization of financial education we can do great things together. Enjoy, Explore and Share.POSTVID.

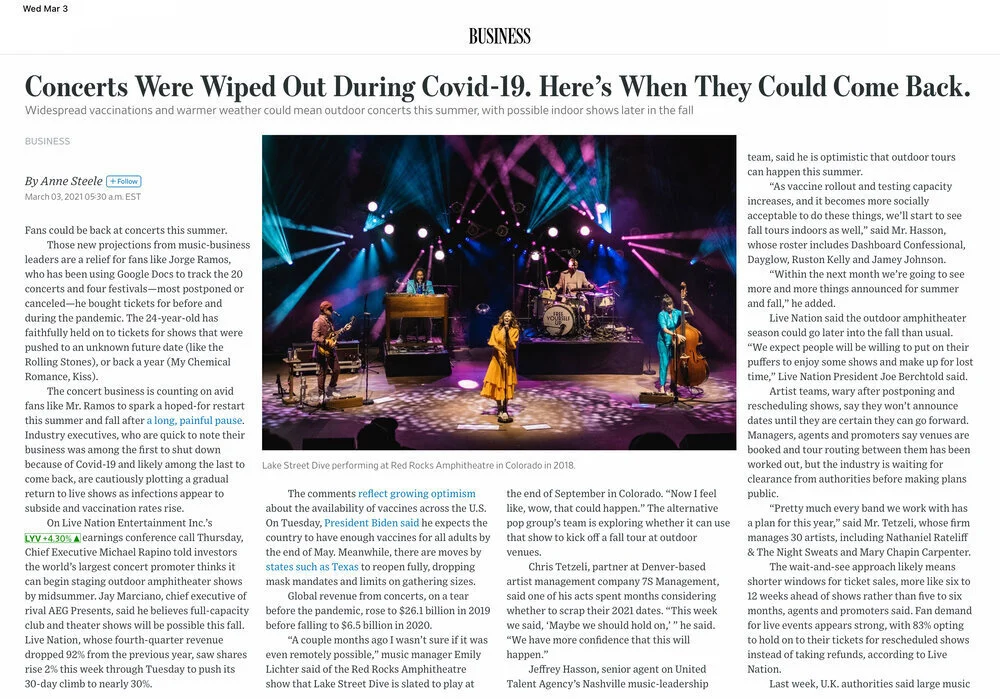

While most of the market has been trading down this week due to continued concerns of higher interest rates, "stay-at-home" stocks which have primarily thrived during the pandemic, seem to have been hit even harder with companies like DoorDash (DASH) and Zoom (ZM) who have plunged 13% and 21%, respectively. With the vaccine rollout becoming more efficient, President Biden has accelerated the timeline in which all adults will have access to the vaccine by the end of May — leading a deceleration in the strong growth that these "stay-at-home" stocks experienced. Tune in to our Tuesday morning bullpen where the team discusses what life could look like for DoorDash and other companies in a post-COVID world.

I can vividly remember the news of the coronavirus first hitting the United States. At the time I was working an internship on Capitol Hill while staying with a buddy of mine from Dartmouth. Little did I know the ding that sounded on my phone one day at work would soon shake up my whole world. The notification from ESPN’s SportsCenter said the Ivy League had cancelled the men’s and women’s basketball tournaments along with the rest of the entire winter sports schedule. I was shocked, to say the least. At that time, the seriousness of the situation had not yet started to sink in. Only a few hundred people in the US had contracted this virus and little was known on its effects. A few weeks later, the university informed us that my spring semester would be moved to remote online learning. All spring sports activities were cancelled.

At that time I was disappointed to be missing out on spring football workouts, even as I understood the precarious nature of the virus. I had always found myself looking forward to spring football. My freshman spring had been an important turning point in my football career. During the fall I was severely underweight and worked countless hours on the field and in the weight room to catch up the level of physique needed to compete on the college level. Spring practice was a chance to put my dedication to the game that I loved on tape in the form of quality reps. During spring ball, the offensive system is slowed down and one gets an opportunity to understand and grasp the playbook. It was during this six-week span that I won and cemented my starting spot at left tackle for the impending fall campaign. Flash forward to late March 2020 and I knew how impactful the loss of a spring practice would be on our football team – especially because we had a young team that had lost a lot of starters and senior leadership. The opportunity to grow as a player and ultimately as a team was now lost.

Although the spring season was no longer on the table, there was still work to be done. It’s funny how everyone comes to watch college football on autumn Saturdays and only sees the finished product. What these patrons do not see is all the time and effort that goes into making those dozen or so Saturdays happen. Football has developed into a year-round sport. If you want to be the best, you can not afford to take days off. Working out and keeping your body in the right shape is the most important thing. During the quarantine, this was especially hard to do, due to the closure of virtually all available gyms. This forced many, including myself, to adapt to home workouts. To say that working out at home was a grind would be an understatement. The equipment you usually use is not around, your room does not feel like a gym and there is a mental block to the whole thing. There’s just something about going to work out with your teammates in a weight room that was lacking at home. You do not feel the same motivation to get after that day's exercises. Fortunately for me, I have a partner to do the strength training with. My little brother Michael is also on the football team with me up at Dartmouth. This gave us a distinct advantage that other of our teammates did not have.

These at-home workouts only subsided in the summer when Texas decided to open up gyms at limited capacity. I remember being so grateful for the opportunity to get out of my house and go lift at a gym. This newfound freedom also allowed me and my brother to now do field work and position specific drills at football fields that were open. Our main focus was to ensure that we were as prepared as possible for the upcoming football season. Only soon we found out some bad news. In July, the Ivy League decided to cancel all fall sports, including football. I was heated. Most Division I schools had at that time decided to proceed with fall sports. I understand the thinking that went behind the decision, but they were not taking into account scientific studies – some of which pointed to the fact that college kids were not at risk of the virus and that the spread of the virus is not as rampant as thought on a field of play.

Having said this, there were some positives to come out of quarantine for me. You do not really understand how much you love the game until it is taken away from you. This almost two-year layoff from playing football has also given me time to mature as a player and leader. It has taught me to take advantage of every opportunity brought to you, because it could be gone in an instant. Lastly, I have learned to fall in love with the process and not the actual game. If you want to become great at what you do, you must enjoy going through the steps that it takes to get you to your end goal.

ATTENDEES:

Geoff Porges - Director of Therapeutics Research and Senior Biotech Analyst for SVB Leerink

Justin Holko - Vice President of Investor Relations - Regeneron Pharmaceuticals, Inc.

Marion McCourt - Chief Commercial Officer - Regeneron Pharmaceuticals, Inc.

Our Friend, Partner and Landlord: Chris Tetzeli — quoted above.

Number of SHARES OUTSTANDING: 73.86 million

Market CAPITALIZATION: $11.677 billion

Share PRICE: $158.10

ATTENDEES:

Ben Swinburne, Head of US Media Research, Morgan Stanley

Bob Chapek, CEO, The Walt Disney Company

This past Monday, Disney’s CEO Bob Chapek attended a Q&A session during Morgan Stanley’s 2021 Technology, Media and Telecommunications Conference, which focused on the accelerated pace of tech adoption due to the COVID-19 pandemic, and the new reliance on tech, connectivity and e-commerce in a post-covid world. On the call, Mr. Chapek discussed Disney’s pandemic response, its direct-to-consumer (DTC) segment, and the company’s strategy moving forward, among other topics.

Summary:

Fiscal Quarter Ended February 14, 2021 (12 weeks)

Net sales for the quarter of $43.89 billion, an increase of 14.7% compared to net sales of $38.26 billion during the similar period last year.

Net sales for the first 24 weeks increased 15.8%, to $86.23 billion, from $74.49 billion last year.

March 4, 2021 Blue Room Meeting #041

Thursday

March 4, 2021

12 PM

__________ __________ __________

BLUE ROOM

MEETING NUMBER Forty One

__________ __________ __________

Joining us for her first Blue Room meeting is Sharon Schneider, who has a rich professional history in philanthropy and impact investing.

BLUE ROOM WEEKLY ICEBREAKER QUESTION —

Imagine that in the future, technology allows you to transport back into the past, to any human in history, subject to human knowledge of that person and time. Which woman would you want to be? The experience can be for one day, one month, one year, one lifetime. You will feel all of the emotions but you will not die. The time spent in the new reality is time spent away from actual reality.

P L E A S E E N J O Y T H E

—WEEKLY—

company updates

from the BR intern team.

AIDAN FETTERLY

AIDAN FETTERLY

Ticker: APPL

Name: Apple, Inc.

Number of Shares Outstanding: 16.94B

Market Capitalization: $2.04T

Stock Price History

February 22 $126.00

February 23 $125.86

February 24 $125.35

February 25 $120.99

February 26 $121.26

March 1 $127.79

March 2 $125.12

March 3 $122.06

March 4 $120.13

March 5 $121.42

Over the last two weeks, shares of Apple, Inc. have fallen approximately 6.9% as the market as a whole has faced a tumultuous run. With bond yields rising and further rumblings from Washington of antitrust allegations being waged across the big-tech sphere, it is unsurprising that APPL, the largest company in the world by market cap, would see a sizable regression in their share price. Questions from analysts have arisen regarding the strength of the company's pipeline, particularly as the release of the iPhone 12 could mark a slowdown in general consumer excitement towards the firm. However, with record-breaking results being reported just a few weeks ago, more than $200B currently on hand, and intentional insertions into the explosive industries of digital streaming and electric vehicles, Apple has both delivered financially and set itself up for further growth in new ventures to come.

Ticker: MRK

Name: Merck & Co., Inc.

Number of Shares Outstanding: 2.53B

Market Capitalization: $185.04B

Stock Price History

February 22 $74.93

February 23 $74.54

February 24 $74.57

February 25 $74.62

February 26 $72.62

March 1 $72.38

March 2 $72.85

March 3 $73.30

March 4 $72.17

March 5 $73.13

In the last two weeks, shares of Merck & Co., Inc. have continued their gradual decline, with the stock posting losses of ~1.6% since market close on February 19. As a stock with such low volatility, performance of MRK shares fell in line with the trends of recent days as bond yields rose and the market as a whole stumbled. On March 4, however, the company announced a cash tender offer to purchase Pandion Therapeutics (PAND), at a price of $60/share. The acquisition enhances Merck's commitment to expanding their reach in the biotechnology field, with Pandion Therapeutics bringing their proprietary TALON drug design platform to the firm.

Ticker: TTWO

Name: Take-Two Interactive Software, Inc.

Number of Shares Outstanding: 115,18M*

Market Capitalization: $19.67B

Stock Price History

February 8 $213.34 (All-Time High)

February 9 $200.31

February 10 $199.82

February 11 $197.12

February 12 $199.86

February 16 $195.79

February 17 $195.93

February 18 $196.23

February 19 $194.86

February 22 $189.85

February 23 $185.95

February 24 $186.99

February 25 $184.68

February 26 $184.46

March 1 $187.45

March 2 $188.17

March 3 $180.15

March 4 $174.03

March 5 $170.81

Over the last two weeks, Take-Two Interactive Software, Inc. (TTWO) shares have undergone an accelerated regression, having now fallen nearly 25% from their February 8 all-time high. With the stock's poor performance as of late and general investor unrest in the market as a whole (particularly in the context of rising treasury yields), it is imperative that one's outlook remains on Take-Two's firm fundamentals. With a strong, although arguably top heavy, IP containing generationally defining titles in an industry continually breaking grounds in popularity and technology, Take-Two holds undeniable value regardless of recent movement. While the long awaited release of Grand Theft Auto VI is already ingrained in the current $19.67B valuation, the continuous growth in the titles predecessor more than 7 years after its release demonstrates that when the title hits the store shelves, disruptions may be made in the industry that currently cannot be predicted. The company's Chairman and CEO, Strauss Zelnick, recently presented at the Morgan Stanley Technology, Media & Telecom Conference, discussing that while user growth across the industry has certainly benefited from stay-at-home orders, the underlying strength of the interactive software industry lies in its age-defying user-retention; a feature that holds true regardless of current restrictions.

Claire McKenna

Ticker: CSGP

Name: CoStar Group, Inc.

Number of Shares Outstanding: 39.42M

Market Capitalization: 31.477B

February 24: $836.23

February 25: $820.00

February 26: $823.76

March 01: $815.00

March 02: $790.17

March 03: $762.80

March 04: $758.46

March 05: $798.85

CoStar Group, Inc. is an industry leader in the technology and commercial property sector. CoStar’s five flagship brands including CoStar Suite, LoopNet, Apartments.com, BizBuySell, and LandsofAmerica. Over the past few months, CoStar Group has placed several bids in an attempt to acquire CoreLogic, a corporation that provides financial, property, and consumer information, analytics, and business intelligence services in the residential marketplace. The proposed deal offered enormous potential for cross-selling and offering new services to residential audiences. However, earlier today, Andrew Florance, Founder and Chief Executive Officer of CoStar Group, withdrew the $7.35 billion offer stating, “with interest rates moving up, now is not the time for us to aggressively buy into the residential mortgage market.” CoStar’s withdrawal from the deal came hours after a letter was published by CoreLogic’s Chief Executive Officer, Frank Martell, stating that CoStar’s offer was not strong enough to compete with Stone Point Capital and Insight Partners’ offer. Therefore, CoreLogic will now officially be acquired by Stone Point Capital and Insight Partners. After the deal fell through, CoStar’s stock jumped 5.5% while CoreLogic’s dropped 4.3%.

John Paul Flores

Ticker: DASH

Name: DoorDash

Number of Shares Outstanding: 317.66M

Market Cap: 47.65B

Stock Price History

February 16, 2021 $205.60

February 17, 2021 $213.82

February 18, 2021 $194.30

February 19, 2021 $200.07

February 22, 2021 $198.00

February 23, 2021 $175.97

February 24, 2021 $174.36

February 25, 2021 $174.41

February 26, 2021 $155.50

March 1, 2021 $171.44

March 2, 2021 $168.00

March 3, 2021 $156.69

March 4, 2021 $147.32

This week has been about as bad of a week as the company has seen in its short-lived history. The stock continued to fall for a sixth straight day and only rebounded when it hit a low of $140 per share. I see this as twofold. The stock is reacting because of the earnings call last week, where it was announced the net loss more than doubled although revenues increased. Compounding this problem is the sell-off of tech stocks in a market that as a whole was in the red. At a time in dire need of good news, I am afraid that you will find none when it comes to DoorDash. As of Thursday night, there was a developing story that has scandal written all over it. According to a CBS Sacramento investigation, Doordash is repackaging some food products as their own. The app says it comes from one of their ghost kitchens, but in all actuality it was a sandwich from a name-brand restaurant. I predict the stock to rebound back up to $160 range in the next few weeks.

Jared Fenley

Ticker: EXAS

Name: Exact Sciences Corporation

Number of Shares Outstanding: 169.1M

Market Capitalization: $2.48

Exact Sciences is a leading cancer company developing tools for early detection, guidance, and monitoring. With a team of over 4,000 employees, including a 400 person R&D team, Exact Sciences develops technology for life science tools and integrated systems for large-scale analysis of genetic variation and function. The company’s leading product, Cologuard, is a non-invasive sDNA screening test for colorectal cancer, which is the leading cause of cancer death in the United States among nonsmokers. Using that sDNA, Cologuard can detect mutations in specific genes by purifying, amplifying, and detecting increased levels of methylation. Cologuard received FDA approval in August 2014, and along with OncotypeDX and OncotypeMAP, more than 4 million people have been tested by Exact Sciences products. The company aims to increase screening and early diagnosis of colorectal cancer, which would increase the survival rate to 90% if the disease is diagnosed early compared to the five-year survival rates of stages 3 and 4 at 71% and 14%, respectively. Utilizing resources from its acquisitions of Thrive Earlier Detection Corp., Base Genomics, and Genomic Health, Exact Sciences is currently developing a multi-cancer liquid biopsy screening test, with preliminary results of 86% sensitivity and 95% specificity in detecting six6 cancer types, that has the potential to revolutionize early cancer screening going forward.

Lexi Linafelter

Ticker: PYPL

Name: PayPal Holdings Inc.

Number of Shares Outstanding: 1.17B

Market Capitalization: $268.95B

March 1, 2021 $273.63

March 2, 2021 $269.19

March 3, 2021 $255.06

March 4, 2021 $239.09

March 5, 2021 $239.05

PayPal Holdings Inc. is an international financial technology and payment processing company providing payment solutions that allow customers to both send and receive payments through a global, two-sided network that connects merchants and consumers. It currently has over 305 million active accounts across more than 200 markets. Early this week, PayPal announced that they have joined Uber in an effort to amplify COVID-19 vaccine equity by committing $5 million to fund free or discounted Uber rides to vaccination sites in underserved communities.

This week, PayPal’s stock price has continued to trend downward, seeing an especially large drop down to roughly $240 dollars per share; this is consistent with many tech stocks that have seen a large rotation from high-quality growth stocks to more cyclical stocks in the past few weeks. PayPal is also looking to move further into the cryptocurrency space following news that they have bid $500 billion dollars on Curv, an Israeli technology firm, engaged in the secure storage of Bitcoin (CRYPTO: BTC) and other cryptocurrencies. The details of the acquisition have yet to be released and are still in early stages, but PayPal is using this opportunity to continue efforts to expand cryptocurrency offerings going forward and plan to add buying, selling and holding capabilities of digital currencies to its Venmo services within the coming months.

Hassan Ali

Ticker: CRM

Name: Salesforce

Number of Shares Outstanding: 917.73M

Market Cap: $191.586B

March 1, 2021 $217.54

March 2, 2021 $213.47

March 3, 2021 $206.00

March 4, 2021 $205.33

March 5, 2021 $208.71

Salesforce is a software-as-a-service company based in San Francisco, California, and is the leader in the Customer Relationship Management (CRM) space with a market share of nearly 20%, more than double its closest competitor SAP at 8%. This week Salesforce is down 3.5% while the S&P 500 has been down 1.5%. This fall in share price could be continued downward momentum from Salesforce’s Q4 and FY 2021 earnings report last week that have left many investors with lingering questions about whether Salesforce can reap a substantial ROI from their pricey acquisition of Slack that is projected to have substantial impacts on their bottom line in FY 2022. Following Salesforce’s earnings call, COO Brent Taylor participated in the Morgan Stanley Technology, Media and Telecom Conference where he provided a more detailed outlook on the acquisition of Slack. For Salesforce their acquisition of Slack was centered around the thesis that the future of work has fundamentally shifted. Many interactions will be digital and they see Slack as a command center for companies where interactions between clients and employees are interfaced on one platform.

Sarah Korb

Ticker: SDGR

Name: Schrödinger

Number of Shares Outstanding: 56.32M

Market Cap: 7.267B

Stock Price History

February 1, 2021 $91.20

February 2, 2021 $93.99

February 3, 2021 $94.84

February 4, 2021 $98.49

February 5, 2021 $99.80

February 8, 2021 $100.00

February 9, 2021 $104.81

February 10, 2021 $105.46

February 11, 2021 $106.07

February 12, 2021 $108.49

February 16, 2021 $111.10

February 17, 2021 $109.61

February 18, 2021 $103.00

February 19, 2021 $102.00

February 22, 2021 $111.22

February 23, 2021 $106.70

February 24, 2021 $109.70

February 25, 2021 $111.40

Schrödinger Inc. is a life science and materials science company with a focus on developing state-of-the-art chemical simulation software for use in pharmaceutical, biotechnology, and materials research. Their physics-based software platform is transforming the way therapeutics and materials are discovered. This past week, Schrödinger’s market value reached an all-time high of $117.00 on February 22nd, 2021; this marks a growth of 154.62% from its original IPO value on February 26th, 2020. Despite this, the past week also showcased major pullbacks in Schrödinger’s market value given current market fluctuations and investors’ concerns over rising bond yields. Schrödinger announced that it expanded its partnership with Google cloud, increasing its original 3-year commitment (since 2019) to a 5-year commitment. As a result, Schrödinger will receive hundreds of millions of graphics processing unit (GPU) hours, effectively tripling their previous throughput and greatly expanding the power of their computational platform. This Friday, February 26th, Schrödinger is due to present at SVB Leerink’s Annual Global Healthcare Conference, which engages and showcases public companies, private companies, and industry experts that are shaping the future of healthcare.

Naia Morse

Ticker: ULTA

Name: Ulta Beauty, Inc.

Market Capitalization: 18.13B

Shares Outstanding: 56.34M

Stock Price History:

February 22, 2021 $314.02

February 23, 2021 $327.09

February 24, 2021 $326.05

February 25, 2021 $337.22

March 1, 2021 $326.77

March 2, 2021 $338.87

March 3, 2021 $337.40

March 4, 2021 $333.52

March 5, 2021 $330.00

Ulta Beauty, Inc. (ULTA), the nation's largest beauty retailer, offers more than 25,000 products from approximately 500 well-established and emerging beauty brands across cosmetics, fragrance, skin care products, hair care products, and salon services. One of Ulta’s main competitors is Walmart as they have a strong business model with approximately 5,000 stores across the U.S., and are diving into the beauty industry. Ulta Beauty and Target announced their partnership towards the end of 2020 with plans to incorporate Ulta Beauty products in select Target stores starting in 2021. In regards to prospective growth in retail, this strategy allows

Target to diversify their products while allowing Ulta to give their loyal consumers what they want: convenience.

Megan Tao

Ticker: ETSY

Name: Etsy Inc

Number of Shares Outstanding: 126.09M

Market Capitalization: $23.552B

Stock Price History

February 16, 2021 $228.32

February 17, 2021 $222.41

February 18, 2021 $220.82

February 22, 2021 $213.12

February 23, 2021 $210.75

February 24, 2021 $209.10

February 25. 2021 $197.58

February 26, 2021 $220.27

March 1, 2021 $244.58

March 2, 2021 $238.43

March 3, 2021 $208.61

March 4, 2021 $198.10

Etsy, Inc. operates online marketplaces where people around the world connect, both online and offline, to make, sell and buy goods. The company’s marketplaces include Etsy.com and Reverb.com, a marketplace for new, used, and vintage music instruments. While ecommerce is a competitive industry, Etsy distinguishes itself from other online marketplaces by selling “one of the kind” items that are custom and handmade. Etsy started off strong this week and reached a 52-week high on Monday, trading at $251.86. However, since then, the stock has been on a decline and is now nearing its one-1 month all- time low, closing on Thursday at $198.10. The initial growth of the stock could be attributed to momentum from Q4 2020 and FY 2020 earnings exceeding analysts’ expectations. However, with the Texas gGovernor removing the state mask mandate and allowing businesses to fully reopen on March 10, the reopening of physical retail stores may be the culprit behind.

My name is Sarah and I am currently a winter intern here at Blue Room. I’m originally from suburban Chicago but my family moved around a bunch growing up. Right now I’m living in New Jersey and I’m currently a junior studying Computer Science and Economics at Dartmouth College. In particular, I am interested in biotechnology and using new technologies to both advance the medical field and make medical therapies more accessible. On-campus, I am a part of Dartmouth Women’s Rugby Team and the Subtleties, an all-female acapella group. Though COVID-19 has made both school and extracurriculars difficult, it has also been a time of major reflection and growth for me.

At Blue Room I’ve been focusing on Schrödinger, a company that provides molecular modeling software to accelerate the drug discovery process for many biopharmaceutical companies and one whose mission I find inspiring. Coming from a place of no experience in the finance sector, it has been challenging and rewarding work, from analyzing stock behavior for our daily updates to building a financial model. Overall, the experience at Blue Room has not only taught me a lot about the world of biotechnology and the power of the stock market but also important interpersonal skills. I’ve learned the power of connection and togetherness, concepts that I’ve come to value greatly as we endure this time of separation.

—Introducing—

THE GRAIN ELEVATOR.

The Twin Peaks Grain Elevator has been a cherished and vital tool for cleaning grains and other commodities in our region. Blue Room is excited and honored to extend our Togetherism ethos and rally around our new partners and Twin Peaks owners Jim and Mike. Our new alliance will help us include, compensate, activate and promote farmland and farmers as the keys to mending the supply chain and helping to fix farms, soil and the planet.

— STAY TUNED & TUNE IN —

10% OF ALL BLUE ROOM REVENUES GO DIRECTLY TO FUND OUR NON PROFIT TOGETHERISM.

WE CAN ACCOMPLISH ANYTHING TOGETHER.