Weekend Update #175

Thank you for your continued support and engagement. Each week, we're sharing what companies we're researching and the what, the who and the how that we think makes the companies interesting and unique. This roundup is brought to you weekly by a group of interns, creative minds, artists and investors who believe that through best in class investing along with the democratization of financial education we can do great things together. Enjoy, Explore and Share.The week started off with investors on edge following the Iranian missile strike on Israel, who was able to intercept 99% of the projectiles with the help of US and British defense systems. This did not help the kick-off of the earnings season the previous Friday, with many major banks reporting and offering mild net interest income outlooks.

Monday saw the latest retail sales data, with March coming in hotter than expected at 0.7% versus an expected 0.3%, which then boosted GDP expectations, sparked a sell-off in Treasury bonds, with the 10-year reaching 4.65% and gold flirting with $2,400 as market participants pushed out bets of the first Fed rate cut out to September. This was further corroborated by Fed Chair Jerome Powell on Tuesday, saying “firm inflation during the first quarter has called into question whether the Federal Reserve will be able to lower interest rates this year without signs of an unexpected economic slowdown.”

In the midst of a challenge share price, Tesla announced it will be laying off 10% of its workforce. ASML, a leading manufacturer of chip-making equipment, reported a 22% year-over-year revenue decline and 66% quarter-over-quarter net bookings declines, prompting a sell-off of the company’s shares. Semiconductor manufacturer TSMC followed suit by scaling back its outlook for a chip market expansion, cautioning that the smartphone and personal-computing markets remain weak, which also sparked a sell-off of its respective shares. Netflix also fell despite beating earnings due to providing lower-than-expected Q2 revenue guidance and saying that starting in Q1 of 2025, it will stop reporting paid quarterly membership and revenue per subscriber.

In sum, the S&P fell for five consecutive days on the heels of elevated Middle East tensions and worries around the Fed’s rate path. Next week will provide more clarity on the state of the economy, as earnings season kicks into full gear, with tech heavyweights Meta, Alphabet and Microsoft all reporting, alongside household names such as Verizon, SAP, Tesla, Boeing, AT&T, Chipotle, Roku and ExxonMobil.

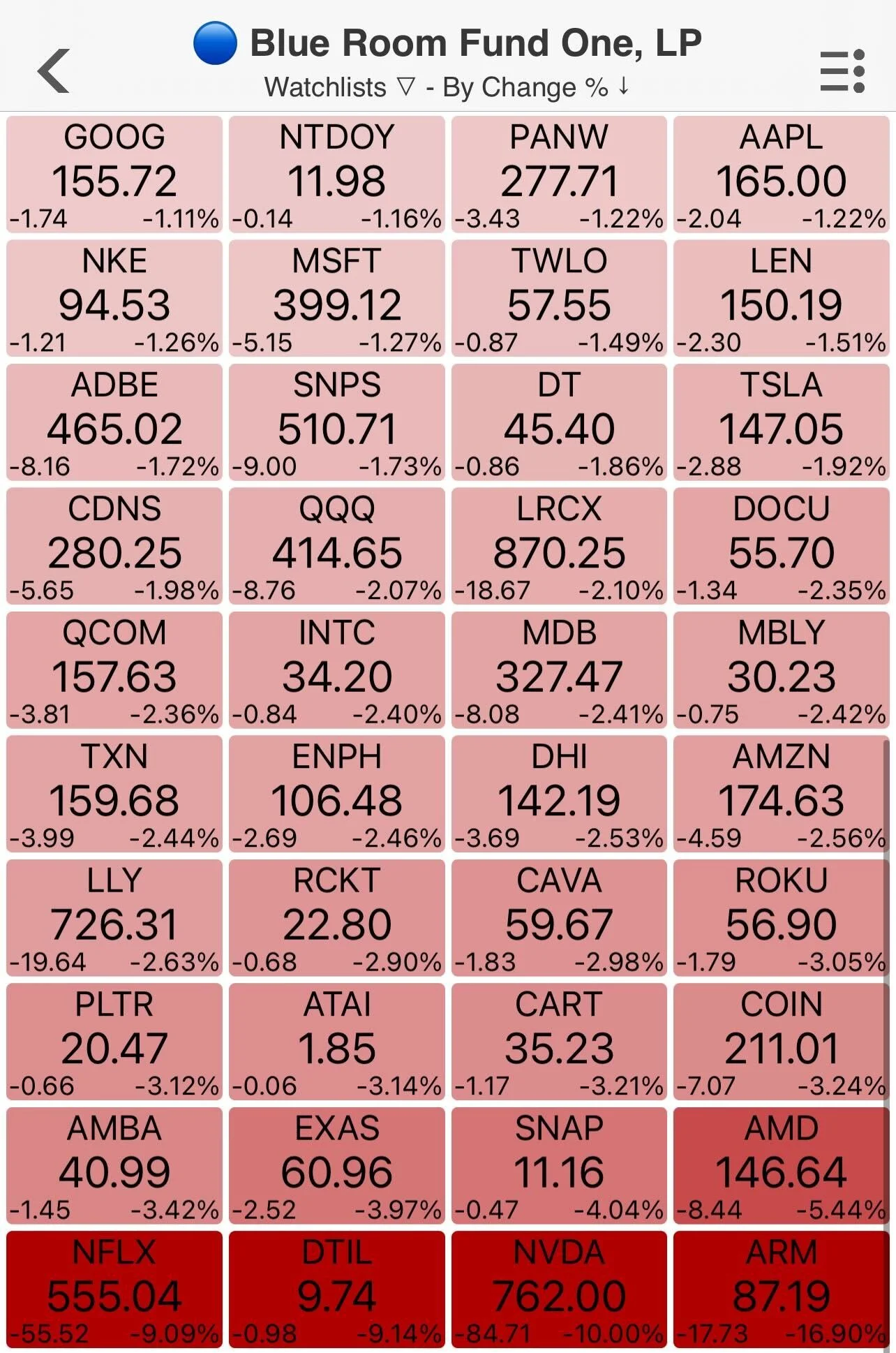

Weekly Performance

S&P 500 4,967.23 (1.86%)

Dow Jones 37,986.40 +0.71%

Nasdaq 15,282.01 (3.78%)

Key Economic Readings Next Week

Monday, April 22 — Chicago Fed National Activity Index

Tuesday, April 23 — S&P Global Composite, Manufacturing and Services PMI; New Home Sales

Wednesday, April 24 — Durable Goods Orders

Thursday, April 25 — GDP; Core PCE QoQ; Pending Home Sales

Friday, April 26 — Headline and Core PCE; U. of Mich. Sentiment; Personal Income & Spending

THank you Blue Room Team Leader OMAR GUZMAN

Markets were rocked at the beginning of the week as geopolitical tensions in the Middle East continued to escalate. Towards the end of the week, the markets were again pressured by comments from the Fed that alluded to potentially pushing rate cuts out further in the year, if they happen at all. With the overhang from all of this negative news, the S&P 500 was down around 4.0%.

Fund One, however, did a much better job of protecting the downside for our investors and outperformed the index by 275 basis points. A large part of this outperformance over the index came from the Fund’s short position in technology company, Arm Holdings. Arm has been a market darling as investors were giving it Nvidia-like credit as an AI play. We felt that the hype was misplaced and this week, other investors agreed by sending shares down nearly 30%.

On the flipside, our holding in Nvidia dropped 12% this week on what we believe is profit-taking following its meteoric run recently. In this case, we feel that Nvidia is a true winner in the AI boom and we are confident that there is plenty more upside for our investors to realize from these levels.

Thank you Blue Room Investing President JOHN FENLEY

Operator

Good morning, and welcome to The Procter & Gamble’s Quarter End Conference Call. Today's event is being recorded for replay.

This discussion will include a number of forward-looking statements. If you will refer to P&G's most recent 10-K, 10-Q, and 8-K reports, you will see a discussion of factors that could cause the company's actual results to differ materially from these projections.

As required by Regulation G, The Procter & Gamble needs to make you aware that during the discussion, the company will make a number of references to non-GAAP and other financial measures. The Procter & Gamble believes these measures provide investors with useful perspective on underlying business trends and has posted on its Investor Relations website www.pginvestor.com a full reconciliation of non-GAAP financial measures.

Now, I will turn the call over to P&G's Chief Financial Officer, Andre Schulten.

Andre Schulten — Chief Financial Officer

Good morning, everyone. Joining me on the call today is John Chevalier, Senior Vice President, Investor Relations. Execution of our integrated strategy drove solid sales and market share results and another quarter of strong earnings and cash results. The strong results we've delivered in the first three quarters of fiscal 2024 enable us to raise our outlook for core earnings per share and keep us on track to deliver within our fiscal year guidance ranges for organic sales growth, cash productivity, and cash return to shareowners.

Specifically on the numbers, organic sales grew 3%. Volume was in line with prior year, showing sequential progress. Pricing contributed 3 points to sales growth as we continue to annualize price increases taken last fiscal year. Mix was neutral to organic sales growth, and growth across categories continues to be broad based with 8 of 10 product categories holding or growing organic sales in this quarter.

Grooming organic sales grew double-digits. Home Care and Hair Care up high singles. Oral Care grew mid-single-digits. Fabric Care, Family Care, Feminine Care and Personal Health Care were up low singles. Skin and Personal Care and Baby Care organic sales were lower versus prior year.

Growth was also broad-based across geographies. North America, Europe and Asia Pacific focused markets and Latin America and Europe Enterprise markets are each growing organic sales. Global aggregate value share was up versus prior year, with 29 of our top 50 category country combinations holding or growing share. Focus markets grew organic sales 2% for the quarter, and Enterprise Markets grew 4%.

Organic sales in North America grew 3% with 3 points of volume growth. Over the last 4 quarters, volume growth in North America has been plus 2%, plus 3%, plus 4%, and now plus 3%. These results include over a point of impact from retail inventory reductions, primarily in personal healthcare.

Consumer demand for P&G brands remains very strong in the U.S., with all outlet consumption value growth of 5%, all outlet value share was up 10 basis points versus prior year. U.S. volume share was up 40 basis points, reflecting continued strong volume growth ahead of the underlying market. The gap between consumer offtake of 5% compared to our U.S. sales growth of 3% reflects the aforementioned trade inventory reductions in the quarter.

Europe focus markets were up 7% with 4 points of volume growth. Value share in Europe Focus markets was up 100 basis points over the past 3 months.

Latin America organic sales were up 17%. Argentina is a significant contributor to this result given the pricing taken to offset the more than 400% devaluation of the Argentine peso since the start of the year. Mexico and Brazil are annualizing high base periods with organic sales growth in the 20s and 30s, and we expect will normalize back to pre-COVID levels in the mid to high single-digits.

As we noted last quarter, there are some specific issues affecting other markets. Those challenges continue to impact results in the quarter.

Greater China organic sales were down 10% versus prior year, progress versus the December quarter, but still impacted by weak underlying market conditions and headwinds for SK-II and other Japanese brands in the market. SK-II sales in Greater China were down around 30% for the quarter. We have seen some month to month improvement in overall Greater China sales trends, though we expect it will be another quarter or two until we return to growth.

Volume trends in some of the European Enterprise and Asia Pacific, Middle East Africa countries such as Egypt, Saudi Arabia, Turkey, Indonesia and Malaysia have remained soft since the start of the heightened tensions in the Middle East. Also, shipments in Russia continue to decline, double digits given our reduced footprint and curtailed investments with consumers and retailers. Combined, the headwinds from Greater China and Asia, Middle East Africa markets were a 150 basis point impact on total company sales for the quarter. We expect these headwinds to moderate or annualize over the coming periods.

Executive Summary

U.S. Bancorp beat the consensus adjusted EPS estimate in Q1 2024 but slightly missed expectations on Net Interest Income, Net Interest Margin, and GAAP EPS. Updated Net Interest Income guidance for Q2 2024 and FY 2024 missed consensus expectations, driven by the new “higher for longer” rates narrative impacting client behavior and changing the expected deposit mix and deposit costs — rotating out of lower-cost deposits into higher-cost deposits. The pace of that rotation continues to slow, but not as quickly as U.S. Bancorp previously expected.

As a result, U.S. Bancorp is looking to additional cost efficiencies that can be implemented throughout the year to lower non-interest expense and are focused on expanding existing client relationships to increase non-interest income at a single-digit pace for the full year. Fee growth in particular is coming from fixed income capital markets activity, wider mortgage spreads, and the payments business. On balance, the guide down in net interest income at the mid point is more than compensated for by the drop in expenses below consensus estimates and raise in non interest income above estimates. The result should be EPS estimates slightly shifting up for FY 2024 based on the updated guidance.

On the earnings call, most of the analyst questions focused on the net interest income dynamics and revision down in the guidance. Although U.S. Bancorp management continues to believe Q2 2024 will represent stabilization and H2 2024 will represent a rebound in net interest income, the guide down and uncertainty about the interest rate and macroeconomic environments are causing some caution around management’s outlook. The lack of guidance on net interest margin was a shortcoming for some as other banks have guided to medium-term NIM targets given some of the potential regulatory impacts to the industry with Basal III Endgame. Some other perceived shortcomings of the earnings commentary was that the efficiency ratio continues to be in 60%+ levels and net charge-offs, primarily driven by credit cards and office space, are expected to increase to the ~60 bps level compared to the prior expectation of 50 bps for the portfolio in FY 2024.

Since last quarter, the sticky inflation readings causing a revision to a higher-for-longer interest rate trajectory have impacted net interest income expectations while overall U.S. Bancorp continues to move toward normalization across the business. Management reinforced that they are in a neutral position to potential upward or downward interest rate shocks, but it is instead the behavior aspect of clients causing the impact to NII and NIM.

Executive Summary

Prevail Therapeutics, a subsidiary of Eli Lilly & Co., announced the termination of its partnership with Precision BioSciences this week. Importantly, no safety concerns or issues found in preclinical development with the assets were the motivating factor for the decision. Minimal insight into the exact rationale for discontinuation was given by either party publicly. Following the news, Precision elected to reacquire the rights to the three programs under the collaboration, which includes the lead asset in the collaboration for Duchenne muscular dystrophy. Precision management asserted that the change does not affect the estimate of cash runway into H2 2026 and has no impact on development of its current pipeline assets.

The termination brings a shift in projected economics for the company, as under the Lilly partnership, Precision was eligible to receive up to $390-395 million in milestone payments per licensed product. However, with the return of the rights to the programs, Precision receives full potential future economic value of those three assets.

With the work completed under the collaboration, all three assets are almost at the point of being prepared for clinical trials, which should increase the value to Precision or potential partners. As the Precision BioSciences team assesses the best path forward for each of the three assets, they will provide updates in the coming months on potential partnership opportunities and may select an asset to take forward in wholly-owned development if they decide they have the resources to do so given the potential value creation opportunity. The business development conversations going on behind the scenes will attempt to maximize economic value to Precision from potential partners, as investors will look for similar economics to the Prevail/Lilly partnership to be achieved.

10% OF ALL BLUE ROOM REVENUES GO DIRECTLY TO FUND OUR NON PROFIT TOGETHERISM.

WE CAN ACCOMPLISH ANYTHING TOGETHER.

These materials do not purport to be all-inclusive or to contain all the information that a prospective investor may desire in considering an investment. These materials are intended merely for preliminary discussion only and may not be relied upon for making any investment decision. Any discussion or information contained in this presentation does not serve as a receipt of, or as a substitute for, personalized investment advice from Blueroom or your advisor.

This publication does not constitute an offer to sell or a solicitation to buy any securities in any fund, market sector, strategy or any other product. Investing is speculative and involves substantial risks (including, the risk of loss of the investor’s entire investment). Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment, investment strategy, or product will be profitable.

For more information about us and our general disclosures contact us directly.